W7 Form 2019-2026

What is the W-7 Form

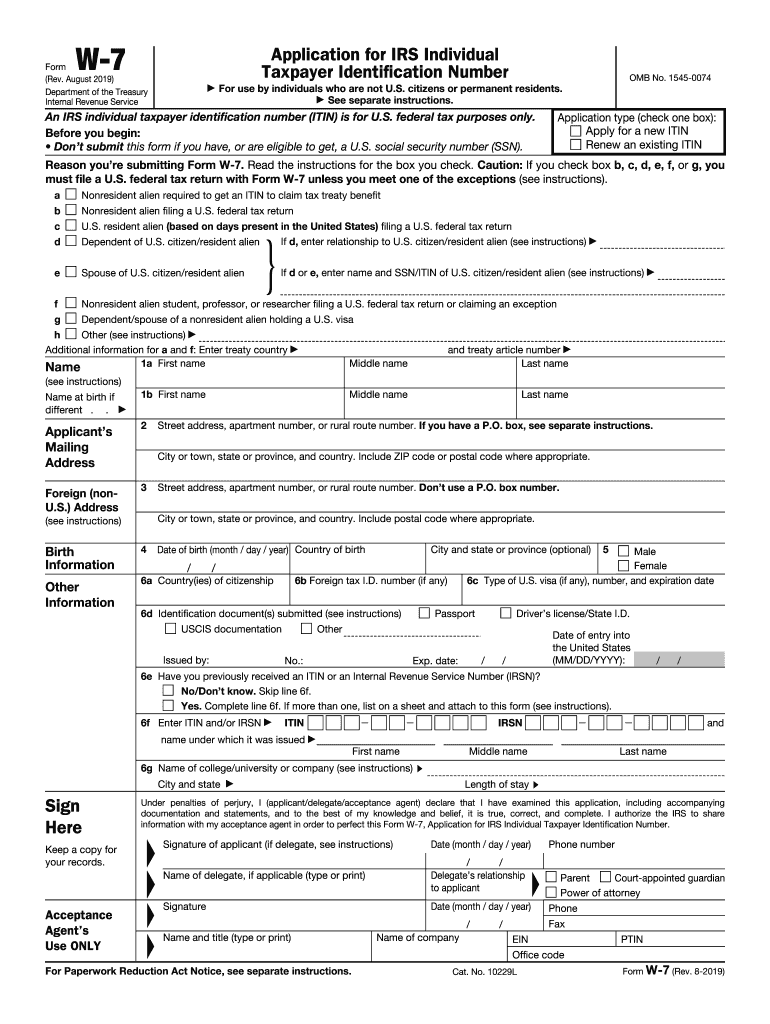

The W-7 form, officially known as the Application for IRS Individual Taxpayer Identification Number, is a crucial document used by individuals who are not eligible for a Social Security number but need to file taxes in the United States. This form is typically utilized by non-resident aliens, their spouses, and dependents. By obtaining an ITIN through the W-7 form, individuals can comply with U.S. tax laws and fulfill their tax obligations.

Steps to Complete the W-7 Form

Completing the W-7 form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of identity and foreign status. Next, fill out the form carefully, providing all required information such as your name, address, and reason for needing an ITIN. After completing the form, review it for any errors, as inaccuracies can lead to delays in processing. Finally, submit the W-7 form along with your tax return or as a standalone application if required.

Required Documents

When submitting the W-7 form, specific documents are required to verify your identity and foreign status. Acceptable documents include a valid passport, national identification card, or U.S. driver's license. In some cases, additional documents may be necessary, such as a birth certificate or other government-issued identification. It is essential to ensure that all documents are current and meet the IRS's requirements to avoid complications during the application process.

Legal Use of the W-7 Form

The W-7 form is legally recognized by the IRS for individuals seeking to obtain an ITIN. This form allows non-resident aliens to fulfill their tax obligations in the U.S. and is essential for those who need to report income or claim tax benefits. Understanding the legal implications of using the W-7 form is crucial, as improper use can lead to penalties or issues with tax compliance.

Form Submission Methods

The W-7 form can be submitted through various methods, including online, by mail, or in person. For those filing with a tax return, the form should be attached to the return and sent to the appropriate IRS address. Alternatively, individuals can submit the W-7 form directly to the IRS by mail without a tax return. For in-person submissions, individuals may visit an IRS Taxpayer Assistance Center, where they can receive assistance in completing the form and submitting it correctly.

Eligibility Criteria

To be eligible for an ITIN through the W-7 form, applicants must meet specific criteria. Primarily, the individual must not have a Social Security number and must need an ITIN for tax purposes. This includes non-resident aliens who are required to file a U.S. tax return, as well as their spouses and dependents. It is essential to review the eligibility requirements thoroughly to ensure compliance and successful application.

Quick guide on how to complete an irs individual taxpayer identification number itin is for u

Accomplish W7 Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed materials, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, alter, and eSign your documents quickly without delays. Handle W7 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign W7 Form with ease

- Obtain W7 Form and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you want to send your form: via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies your document management needs in just a few clicks from your selected device. Edit and eSign W7 Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct an irs individual taxpayer identification number itin is for u

Create this form in 5 minutes!

How to create an eSignature for the an irs individual taxpayer identification number itin is for u

How to make an eSignature for your An Irs Individual Taxpayer Identification Number Itin Is For U online

How to create an electronic signature for your An Irs Individual Taxpayer Identification Number Itin Is For U in Chrome

How to generate an electronic signature for putting it on the An Irs Individual Taxpayer Identification Number Itin Is For U in Gmail

How to create an electronic signature for the An Irs Individual Taxpayer Identification Number Itin Is For U straight from your smart phone

How to make an eSignature for the An Irs Individual Taxpayer Identification Number Itin Is For U on iOS devices

How to create an eSignature for the An Irs Individual Taxpayer Identification Number Itin Is For U on Android devices

People also ask

-

What is the W7 Form and why is it important?

The W7 Form is an application used by non-resident aliens and others to obtain an Individual Taxpayer Identification Number (ITIN) from the IRS. It is essential for anyone who needs to file a U.S. tax return but does not qualify for a Social Security number. Understanding the W7 Form is crucial for compliance with U.S. tax laws.

-

How can airSlate SignNow help with the W7 Form process?

airSlate SignNow simplifies the process of completing and signing the W7 Form by providing a user-friendly platform for electronic signatures. You can easily create, send, and track your W7 Form documents securely, ensuring that all information is accurate and submitted on time.

-

Is there a cost associated with using airSlate SignNow for the W7 Form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. While there is a subscription fee for accessing premium features, you can also take advantage of a free trial to see how our solution can streamline your W7 Form submissions.

-

Can I integrate airSlate SignNow with other applications when working on the W7 Form?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications including Google Drive, Dropbox, and CRM systems. This means you can manage your W7 Form documents alongside other tools you already use, enhancing your workflow efficiency.

-

What are the key features of airSlate SignNow for handling the W7 Form?

Key features of airSlate SignNow include customizable templates, secure eSigning, and real-time tracking of document status. These features make it easy to manage the W7 Form process, ensuring that you can send and receive signed forms quickly and securely.

-

How does airSlate SignNow ensure the security of my W7 Form submissions?

airSlate SignNow employs advanced encryption and security measures to protect your documents, including the W7 Form. We adhere to industry-standard security protocols, ensuring that your sensitive information remains confidential throughout the signing process.

-

What benefits does airSlate SignNow offer for businesses handling the W7 Form?

By using airSlate SignNow for your W7 Form needs, businesses can reduce paperwork, save time, and improve accuracy in document submission. Our solution allows for faster turnaround times and increases efficiency, enabling businesses to focus more on core activities.

Get more for W7 Form

- Skylines medical group p a obstetrics gynecolo form

- The following is a confidential questionnaire which will help us determine the best possible course of treatment for you form

- Pathlabs ufl edupathology laboratories college of medicine university of form

- Kaiser permanente radiology imaging request form

- Application deadline 430 p form

- Uw medicine request for minor proxy mychart access form

- Environmental health safety httpwp research u form

- Opioid induced constipation oic in patients with chronic non cancer pain form

Find out other W7 Form

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple